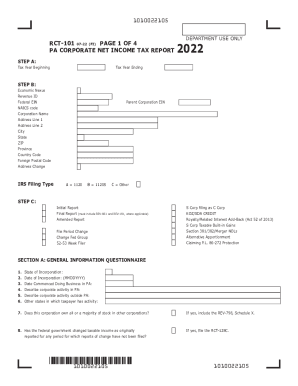

PA DoR RCT-101 2023-2024 free printable template

Get, Create, Make and Sign

Editing pennsylvania corporate tax online

PA DoR RCT-101 Form Versions

How to fill out pennsylvania corporate tax 2023-2024

How to fill out 2023 pa corporate net

Who needs 2023 pa corporate net?

Video instructions and help with filling out and completing pennsylvania corporate tax

Instructions and Help about tax filed form

Music lets start with the most basic thing what is endodontics even mean what's the root of it, so end of course is from Greek and DOM which is within okay and on --TX is from Greek ode on tooth so inside the tooth within the tooth that's what we do I'd like to think of the analogy of the root is like a Twinkle cake okay the cake is like the hard route of your tooth, and it's really the cream filling that were after were going to clean out the cream filling and then reseal the Twinkle cake that's what a root canal is and that resonates with patients so but this is actually the tooth that were gonna that were going to treat today so here sour chief complaint so with our patient healthy patient no medications patient has had some symptoms for about a month what happened was to see when he had a crown it had some leakage under it, so the dentist removed the crown did a bit of a build-up after removing decay, so he put some IRM in there which you'll see, and then he made a nice temporary crown, so the patient has a temporary crown in place, so I'll be removing the temporary crown you'll see that kind of temporary buildup and well access right in through that first step again were gonna look at access opening we've all kind of taken a look Frank we all looked at the x-rays and the scan that we did so now we want to recognize that we want to try to make what's basically going to be a little of a trying not triangular but a more of a rectangular form here now this is that IRM that I mentioned that his dentist had placed to build up the tooth those under the crown there was decay okay so well get started here, and you'll see as well make just a little approach I kind of make just a miniature form of what I expect the access to look like you'll see some dentin come through here and some of this IRM will probably just chip right away and if its loose we kind of don't really want it there so in this case I'm going to kind of just plug it out of there and so now this is all the Denton there we go, so this change in coloration here is probably almost the beginning of the pulp chamber so now well make a little more of an approach here I'm going to step off, and you'll see just a little more were going to make a little progression what were trying to get into it's just the very top of that pulp chamber because once we get to that point we really know where we are, so I'll just go real slow here well just step by step, so you can really see the progression okay, so now we look down in there, and we start to just give it a little up hello see that so that's step number one once you can get to this point frankly you're feeling that at all you do feel to touch which is why I'm asking because its very common even with full anesthetic I did cold again he didn't feel anything once you reach into that tissue as I mentioned it changes I think just a little pinch here for a second, and then it's going to fade right away, so I get right back to that spot you're going to...

Fill tax annual income : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your pennsylvania corporate tax 2023-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.